Reduce delinquency & delight borrowers with Flex

Empower your customers to split monthly auto payments into two installments—while your business gets paid upfront and on time, every time.

Flex pays $12B in customer bills annually

- 4.8

Guaranteed on-time payments

- Lower delinquencies: prevent costly repossessions and reduce financial risk.

- Boost operational efficiency: save staff time and effort with automated, reliable payment collection.

- Enhance dealer relationships: strengthen dealer satisfaction by offering consumers more flexible payment options.

- Zero cost to your business: absolutely no fees or operational costs for lenders.

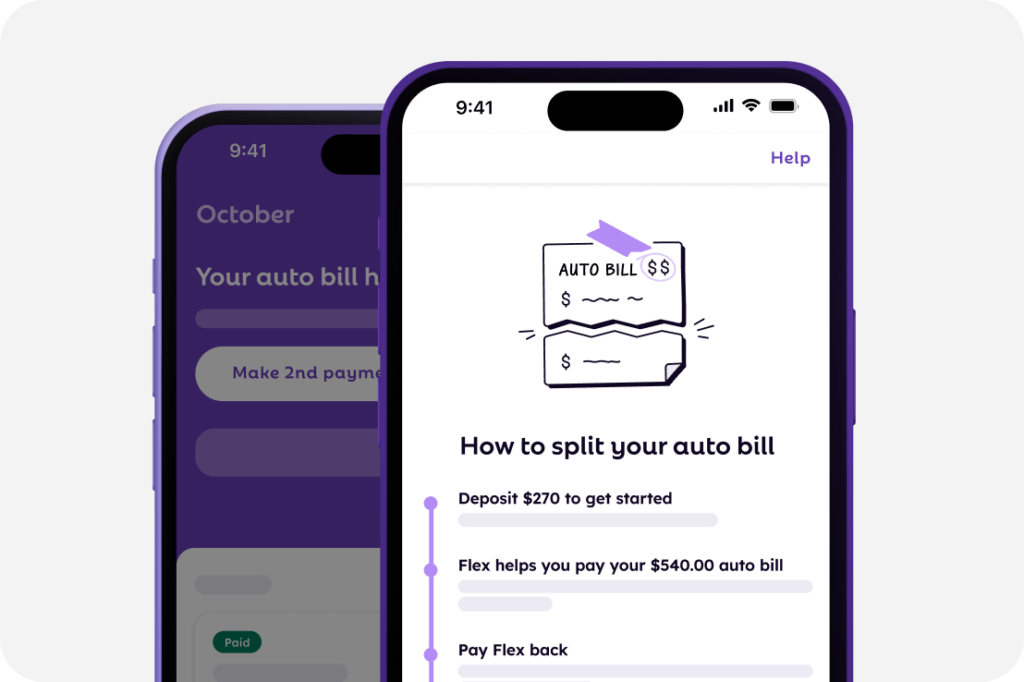

Put bill collection on autopilot

Empower greater cash flow management

Flex pays monthly auto payment on behalf of customer

Users pay their bill to Flex in two payments

Flex pays monthly auto payment on behalf of customer

Users pay their bill to Flex in two payments

What your customers get

- Flexible budgeting: split payments align with payday schedules for easier budgeting.

- Financial control: no long-term contracts, late fees, or penalties.

- Peace of mind: predictable, manageable payments each month.

Why now?

Car payments are at record highs

Subprime auto loan payments are 30% higher than pre-pandemic level.¹

Americans are struggling to keep up

Auto loan delinquencies are nearing Great Recession peaks, driving up repossessions by 10% year-over-year.²

The cycle worsens consumer costs

Rising delinquencies and repossessions increase lender losses, leading to higher interest rates and tougher credit conditions, further trapping subprime borrowers in high-cost debt cycles.

¹ Experian’s Quarterly State of the Automotive Finance Market Report. ²Cox Automotive.

Flex can help keep your customers stay on the road while improving your bottom line

Flexible Finance, Inc., together with its subsidiaries (“Flex”), is a financial technology company, not a bank. All loans, lines of credit (including “Flex Rent”), banking services, and payment transmissions are offered by Lead Bank or Column N.A., Member FDIC. An application and credit assessment are required. Unsecured lines of credit for Flex Rent are provided for a recurring monthly membership fee up to $14.99; membership automatically renews until canceled. A bill payment fee of 1% of your total rent amount is also charged (an additional 2.5% processing fee applies when using a credit card). Term loans for Flex Move-in are provided at 16.95%-23.84% annual percentage rate (APR) based on state of residence, loan duration, and other relevant factors. A bill payment fee of 1% of your initial payment amount is also charged. Term loans are currently only available to eligible customers in certain states. While Flex does not charge late fees, other third party fees (including at your property’s discretion) may apply. See your offer for more details. Positive rent payment history and information about your loan may be reported to one or more national credit bureaus. All loan amounts vary based on eligibility. Any graphics are for illustrative purposes only. Terms and conditions apply. All loan proceeds are disbursed by Lead Bank or Column N.A., Member FDIC; neither Flex nor any of its subsidiaries disburse loan proceeds or engage in the movement of consumer funds. Brokering activities are performed by Flexible Finance Brokering, Inc. Servicing and collection activities are performed by Flexible Finance Servicing, Inc.

Column, N.A. only supports Flex Rent at this time.

Licenses

Flexible Finance Brokering, Inc., Nationwide Multistate Licensing System (“NMLS”) ID #2599800

Flexible Finance Servicing, Inc., NMLS ID #2256673

Please refer to NMLS Consumer Access for information on our licenses

Vermont Residents: THIS IS A LOAN SOLICITATION ONLY. FLEXIBLE FINANCE BROKERING, INC. IS NOT THE LENDER. INFORMATION RECEIVED WILL BE SHARED WITH ONE OR MORE THIRD PARTIES IN CONNECTION WITH YOUR LOAN INQUIRY. THE LENDER MAY NOT BE SUBJECT TO ALL VERMONT LENDING LAWS. THE LENDER MAY BE SUBJECT TO FEDERAL LENDING LAWS.

All product names, logos, brands, and trademarks are the property of their respective owners. Use of these names, logos, and brands does not imply endorsement.