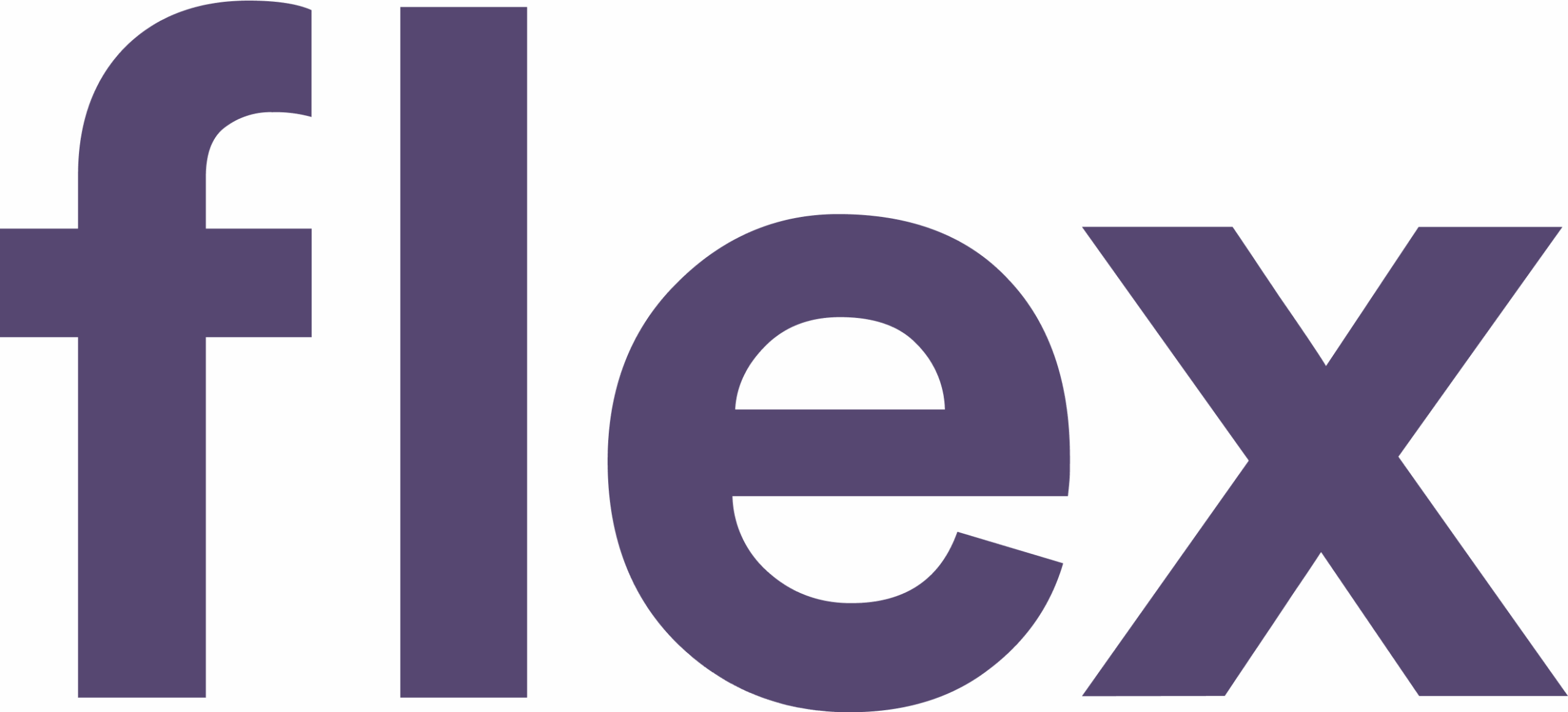

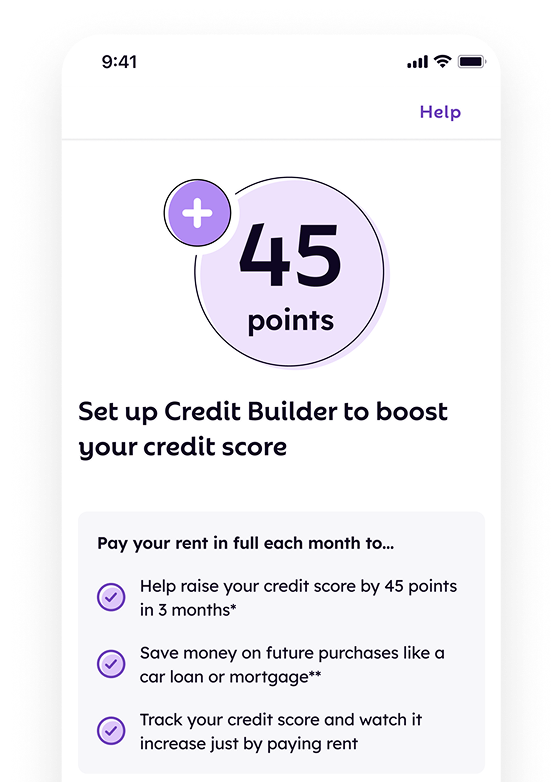

Build your credit by paying rent

Credit Builder can help improve your credit score by an average of 45 points in 1 month*

How Credit Builder works

Sign up for Credit Builder

Sign up for Credit Builder

If approved, you’ll receive a secure line of credit equal to your rent amount.

Pay rent through Flex

Pay rent through Flex

Pay your full rent amount through Credit Builder like you normally would to your property.

Rent gets paid to your property

Rent gets paid to your property

We’ll use your line of credit to pay rent to your property. Then pay it off with the money you already provided through Credit Builder.

Build credit history

Build credit history

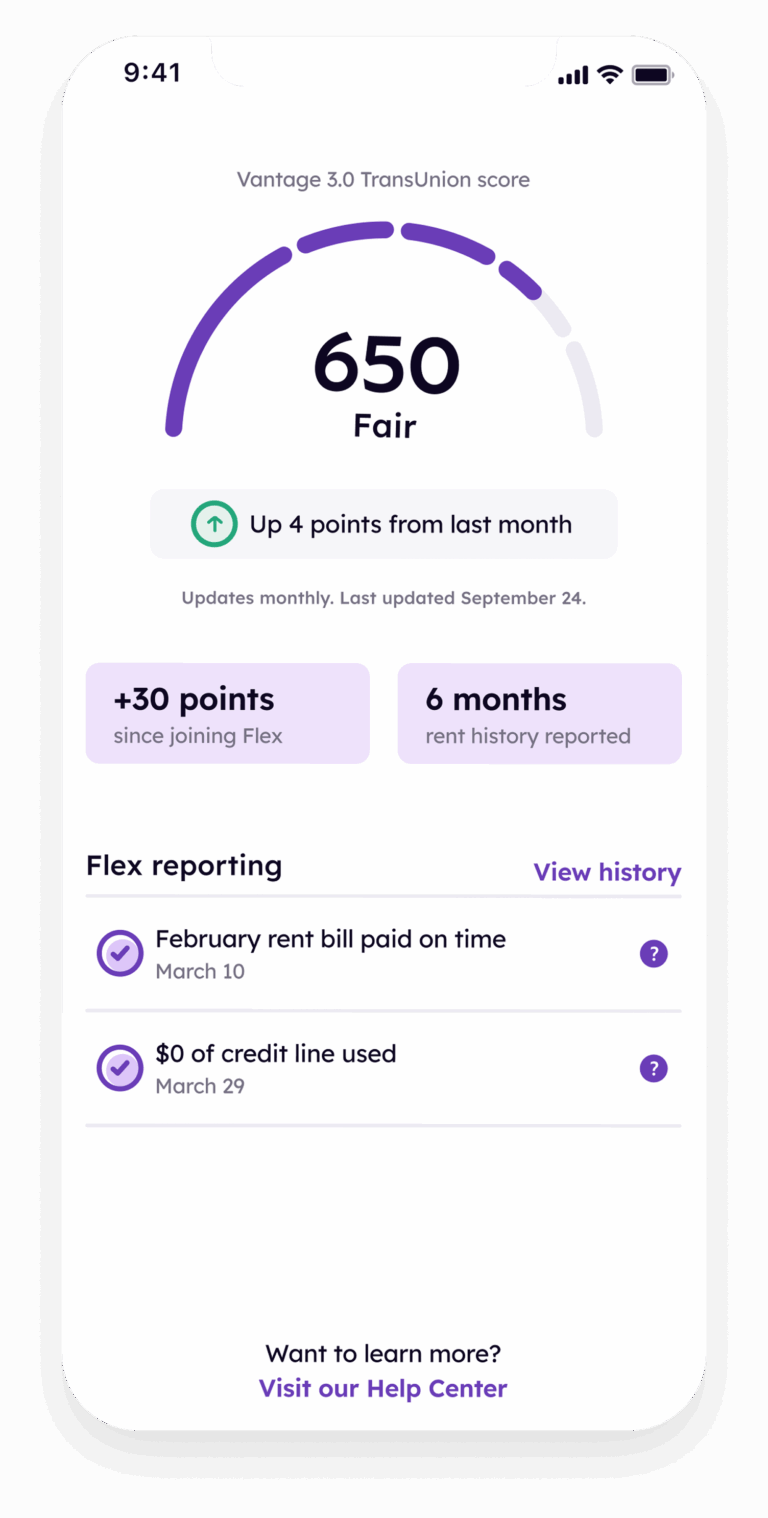

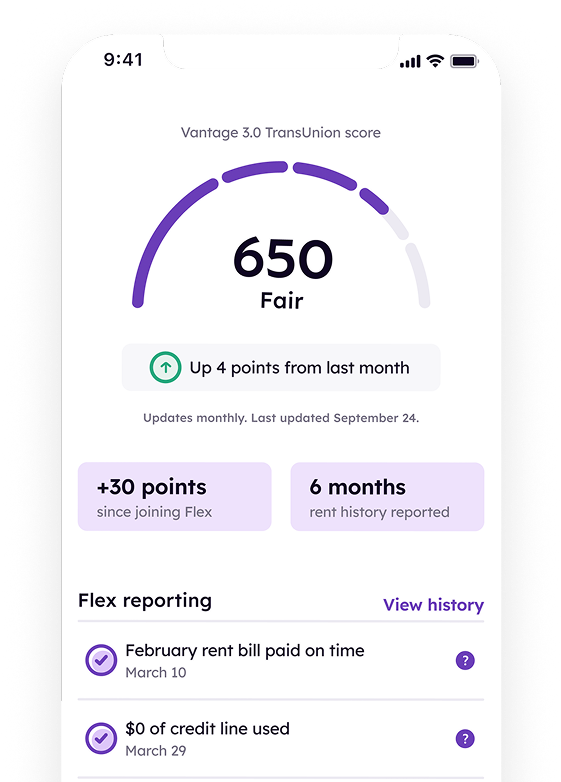

We’ll report your on time payment and $0 balance on your credit line, which can improve your score.

How Credit Builder works

Sign up for Credit Builder

Pay rent through Flex

Rent gets paid to your property

Build credit history

We’ll report your on time payment and $0 balance on your credit line, which can improve your score.

Open new financial opportunities

Boosting your credit score can lead to better loan and credit card rates, saving you money over time. It also improves your chances of renting a home, securing lower insurance premiums, and even enhances job prospects where financial responsibility matters.*

*Individual results vary. Average outcome for customers who opened a Credit Builder account with a starting VantageScore 3.0 with a credit score between 580–620 and made consistent, on-time payments for at least three months. Factors other than on time payments, including interactions with other creditors, also play a role and may impact results. Payment history will be reported to TransUnion. Past performance does not guarantee future results, and a credit score increase is not guaranteed.

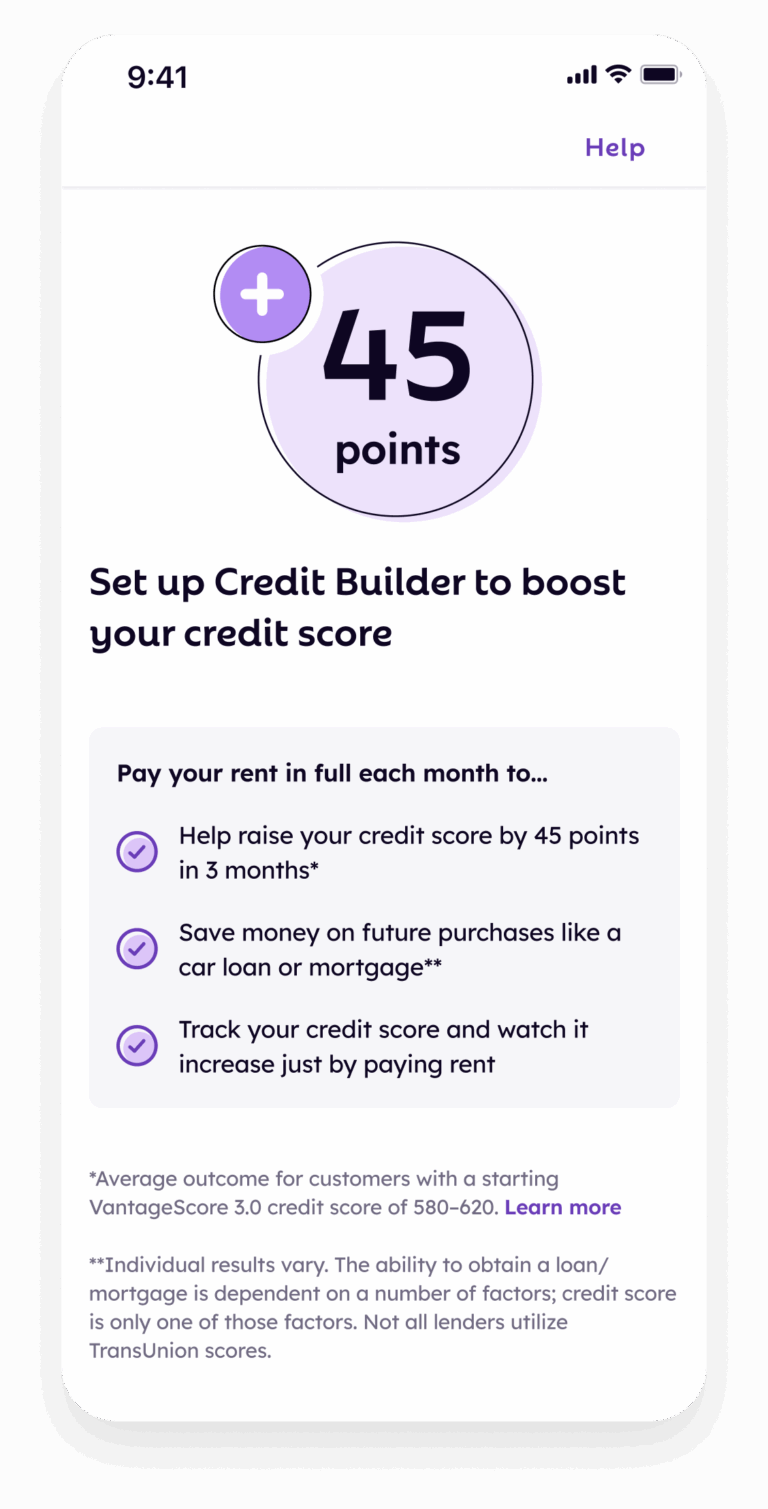

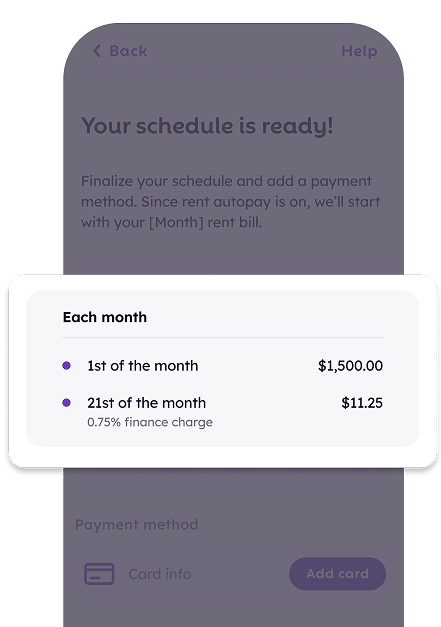

An affordable way to build your financial future

We charge a 0.75% finance charge when you use Credit Builder to pay your rent. There’s no additional monthly membership fee. For some customers, that’s less than they’re currently paying to process their rent payment online. You may be subject to an additional $3 property passthrough fee depending on your property.*

*There is no processing fee when paying with a debit card. An additional 2.5% processing fee applies when using a credit card. Pricing and features are subject to change. For the most accurate pricing information, you can check the Flex app or contact our support team for assistance.