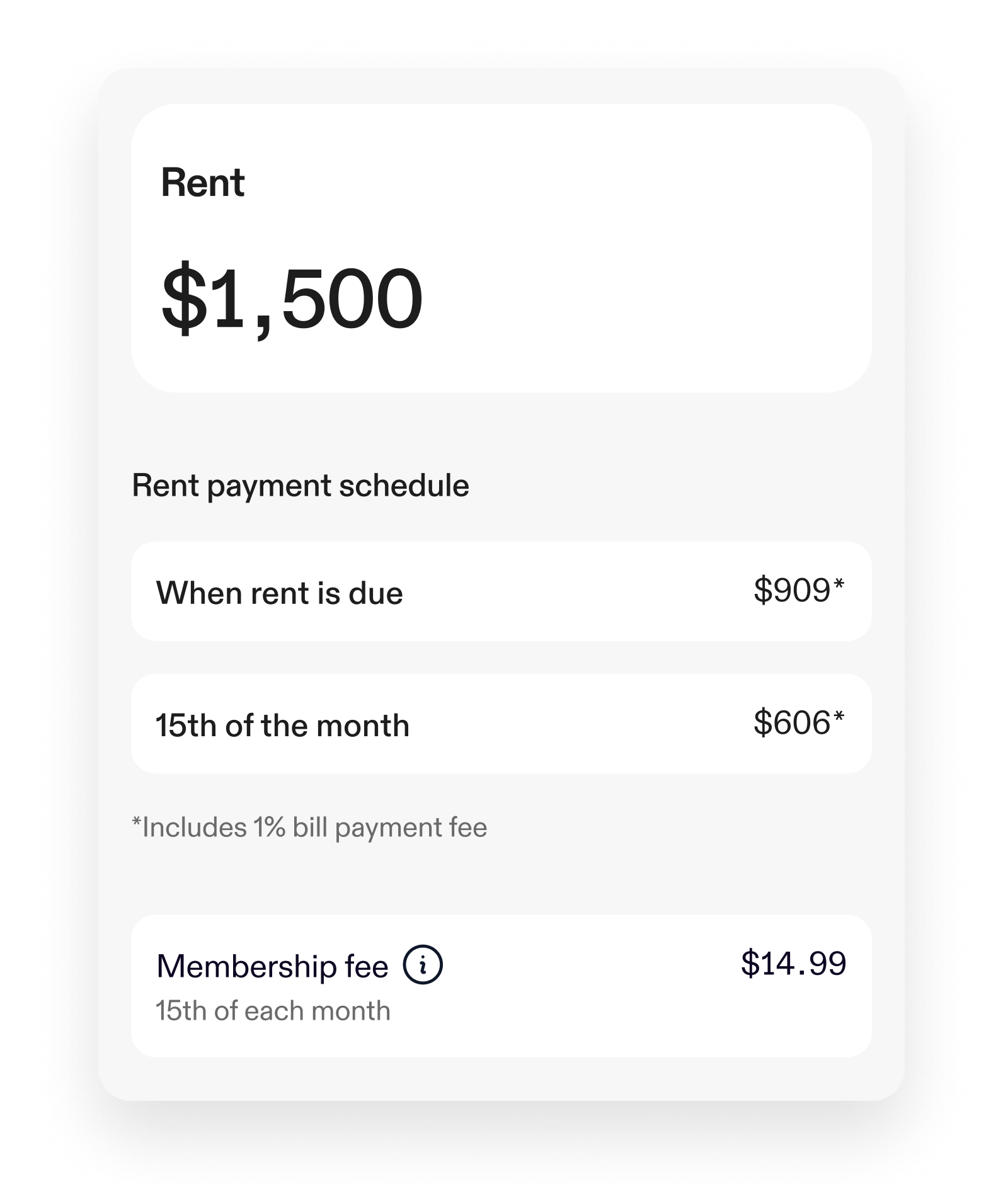

Split your rent into two payments

Flex gives you access to a credit line so you can pay part of your rent later and breathe easier each month.

Works wherever you rent.*

*Subject to renter and landlord eligibility. Terms and conditions apply.

Works wherever you rent, however you pay

How flexible Rent works

Make your rent schedule work for you.

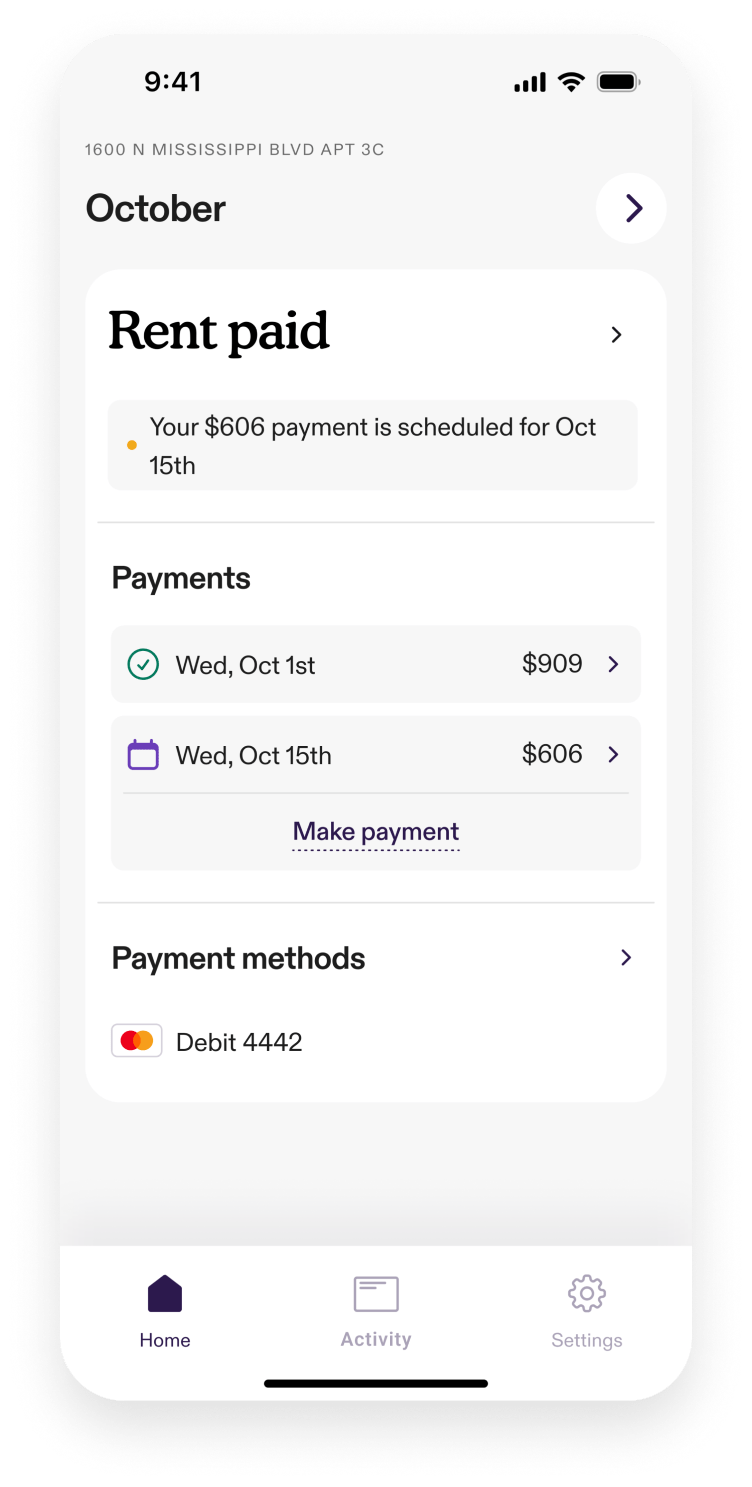

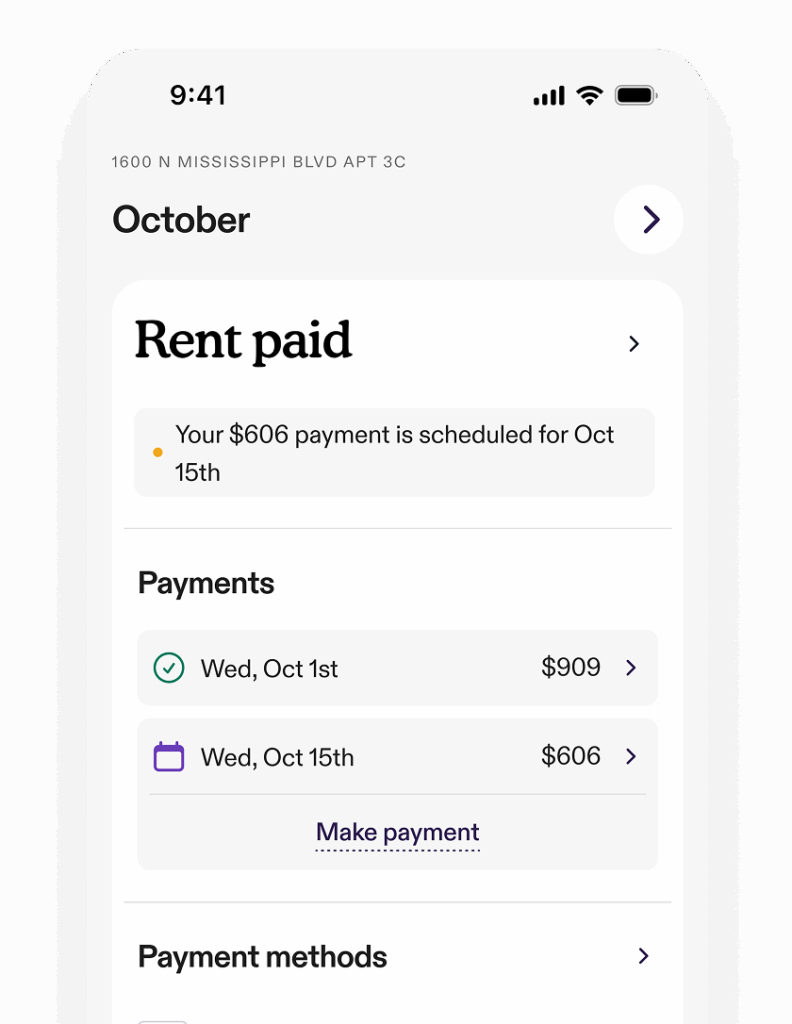

Rent gets paid in full

Rent gets paid in full

As long as you pay part of your rent when it’s due (your 1st payment), Flex will cover the rest with what you borrow from your credit line.

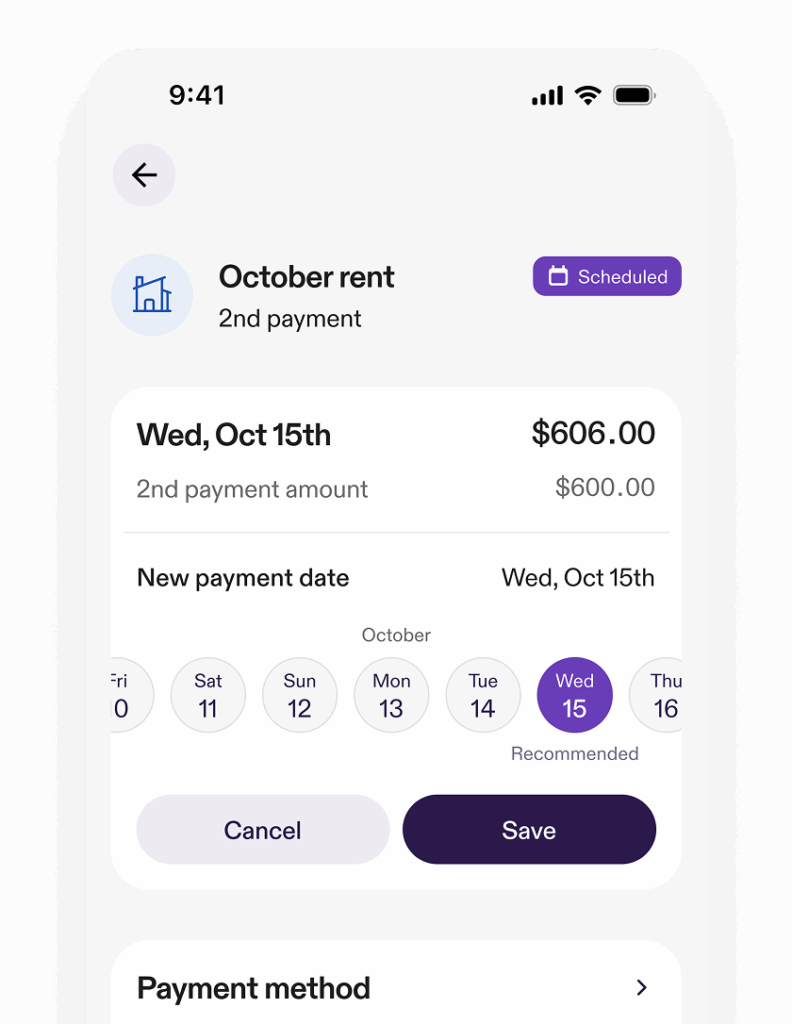

Pay Flex back on your schedule

Pay Flex back on your schedule

Make a 2nd payment to pay off your credit line before the end of the month.

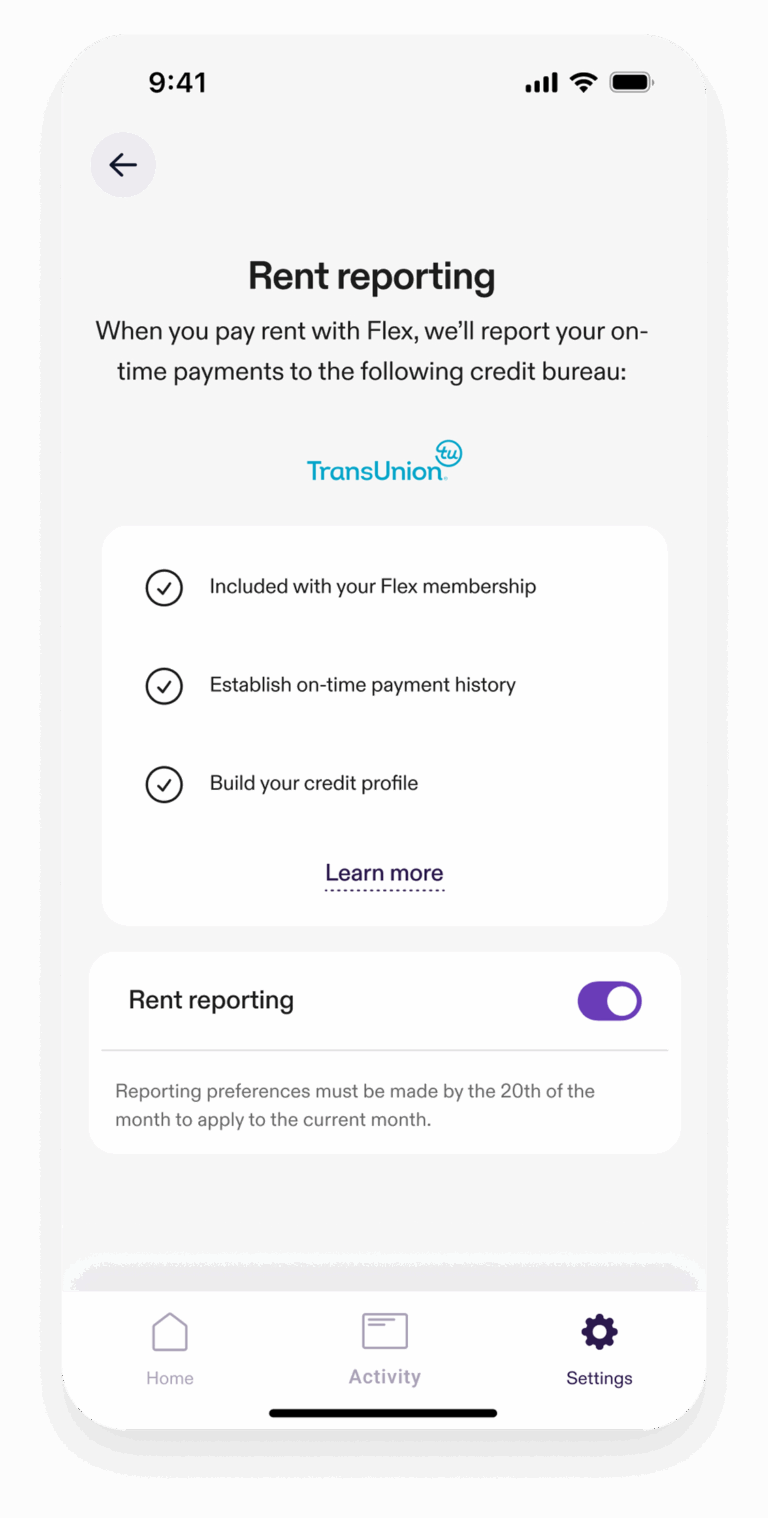

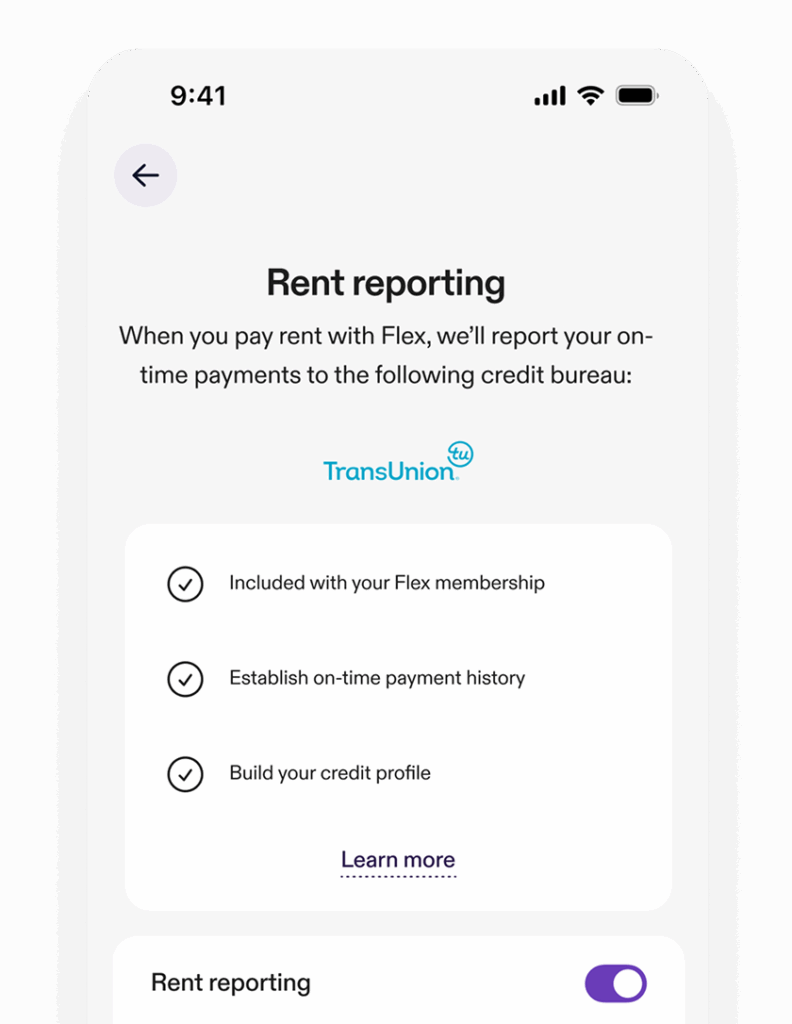

Build credit history

Build credit history

Your on-time rent payments may be reported to TransUnion to help you establish payment history and build your credit profile.

How flexible Rent works

Make your rent schedule work for you.

Rent gets paid in full

As long as you pay part of your rent when it’s due (your 1st payment), Flex will cover the rest with what you borrow from your credit line.

Pay Flex back on your schedule

Make a 2nd payment to pay off your credit line before the end of the month.

Build credit history

Your on-time rent payments may be reported to TransUnion to help you establish payment history and build your credit profile.

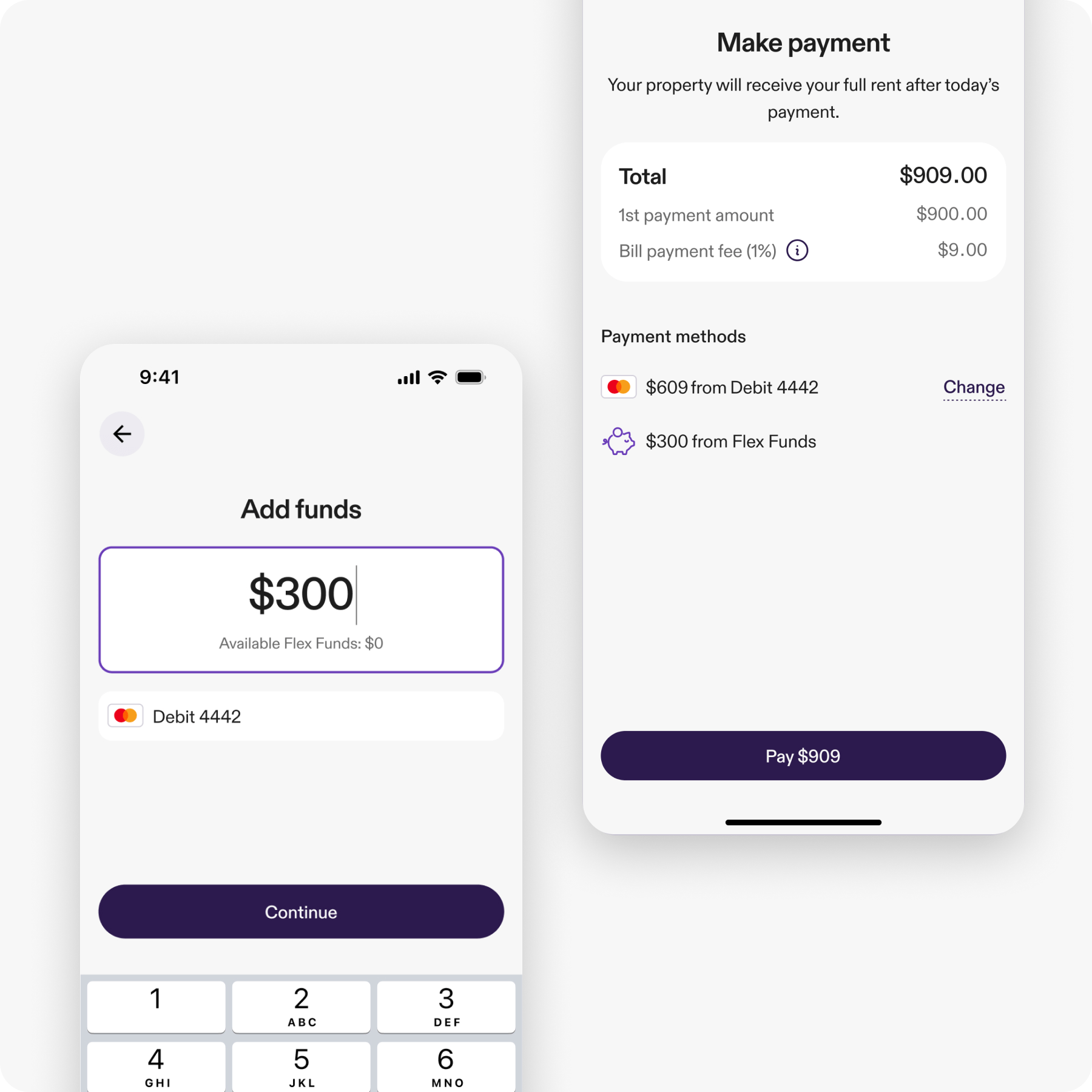

Get ahead of rent with Flex Funds

With Flex’s wallet, you can set money aside whenever you have it—making budgeting even easier. When it’s time to pay, we’ll apply your Flex Funds directly to your payment. You can also withdraw them if plans change.*

*Some users may not have access to this feature yet. Limitations apply.

Take control of your finances

Flex membership is $14.99/month which gives you more control, flexibility, and financial peace of mind—every month. 1% bill payment fee also applies when you pay rent through Flex.*

*You may be subject to an additional $3 property passthrough fee for each month you use Flex, depending on your property. There is no processing fee when paying with a debit card. An additional 2.5% processing fee applies when using a credit card.

Frequently asked questions

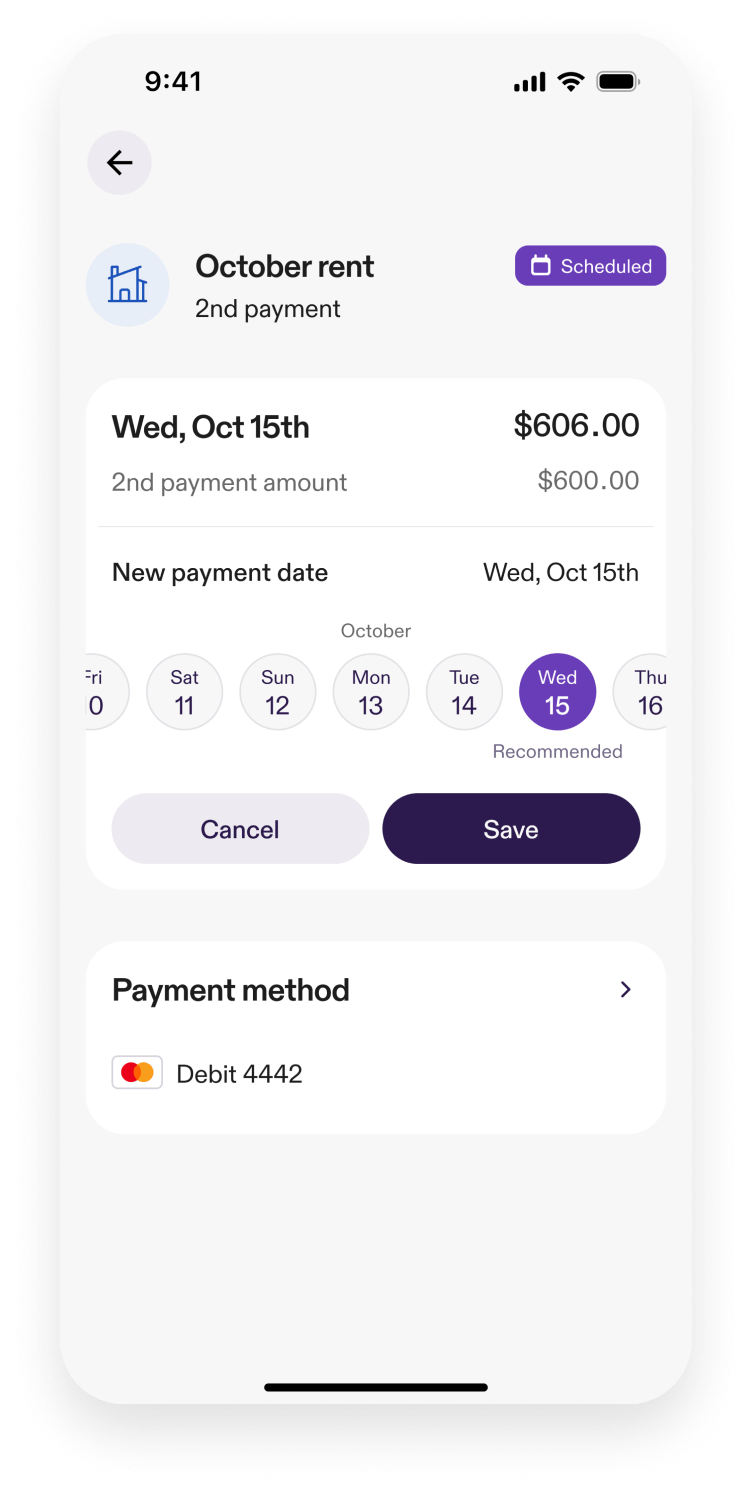

Can I change my payment schedule?

You have the flexibility to reschedule your 2nd payment directly in the Flex app after your rent is processed. When rescheduling, you can choose any business day up to the last day of the current month.

What happens if my rent fluctuates month over month?

We understand that rent amounts can vary each month, so Flex will adjust the amount of your payments to cover small fluctuations. However, if the rent amount posted by your property is significantly higher or lower than the estimated rent amount you provided during sign-up, Flex will ask you to confirm the rent amount that our system should process before submitting your rent payment.

How do I know if I’m eligible to use flexible Rent?

Flex Rent is available to every renter in the U.S. You must be 18 years of age or older and qualify for a Flex Rent credit line, which we evaluate when you apply, based on your credit report information, payment history, and other factors. You also need to have a debit or credit card to make your payments to Flex. Approval is subject to renter and landlord eligibility. Terms and conditions apply.

What is rent reporting?

Rent reporting is an optional feature that is included in your flexible Rent membership. When you pay your rent with Flex, we will automatically report your on-time rent payment to TransUnion – building your on-time payment history. Flex will never report anything but on-time payments to the credit bureau(s). More details on rent reporting here.

I don’t see my property listed during onboarding, can I still use flexible Rent?

Yes! You can still split your rent with Flex. If your property isn’t listed but you pay rent through an online portal, we’ll provide you with a Flex bank account or debit card to make your payment. Once you successfully sign up for flexible Rent, you’ll receive a welcome email with specific instructions on how to do so. If you pay rent directly to your landlord, you’ll be prompted in the signup process to invite your landlord to accept your rent through Flex.

Do I need to use Flex every month?

Flex Rent is designed to give you the freedom to use it when it works best for you whether that’s every month or as needed. With your monthly membership fee, your Flex Rent Line of Credit stays active and ready for when you need it. If you cancel your Flex account, you’ll need to re-apply to use flexible Rent again in the future.