Is late rent holding your property management business back? Discover how offering flexible rent payments can help you increase on-time collections, boost resident satisfaction, and streamline operations.

of residents say digital payments would improve their view of their property management company

US residents spend more than 30% of their income on rent

of digital transformation projects succeed

of businesses offering flexible payments report positive impacts on their operations

In this comprehensive guide, you’ll learn:

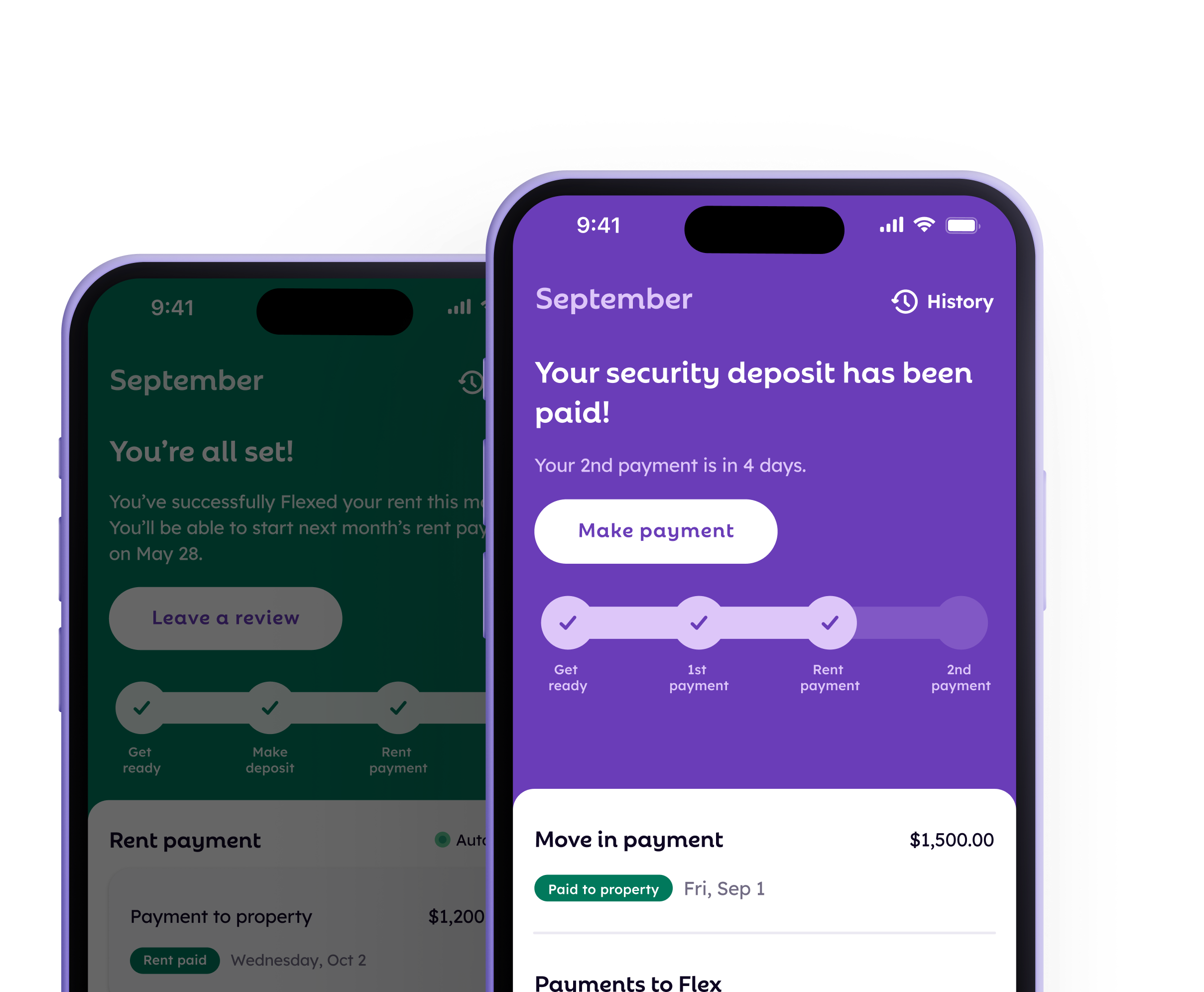

Flexible rent payments empower residents to pay on a schedule that works for them while ensuring you receive full rent reliably each month. By aligning rent with your residents’ cash flow, you can reduce delinquencies and stabilize your rental income.

Stop chasing rent and start offering your residents the modern, convenient payment options they expect.

Download the guide now to see how flexible payments can drive efficiencies and on-time payments for your business.

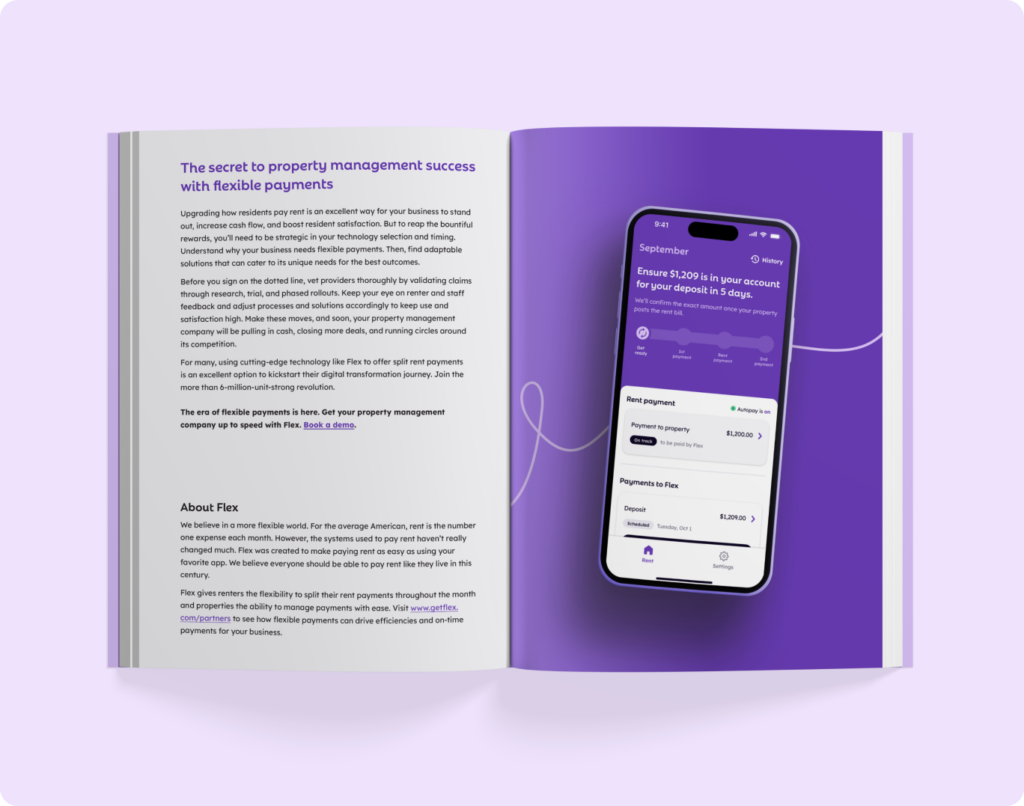

About Flex

Flex is a leading flexible rent payment platform that allows residents to split rent into customizable installments while ensuring properties receive full rent on time, every time. Join the 6+ million unit revolution and bring your rent collection into the 21st century with Flex.